Few would argue that insurance offers value for money.

That’s why we created UP!

Business as Usual no longer exists. Insurers, banks and finance companies must adapt their products and services to meet the significant financial and operational challenges and volatility organisation face.

Why though? The pandemic, net zero and ESG factors are highlighting shortcomings in business models, risk profiles and risk appetites. This is in addition to the impact new risks are having on cashflow projections, most noticeable in ongoing supply chain challenges. What this means: The cost of capital and contingent capital must absorb the cost of these new risks. Organisations can only be sustainable if they remain going concerns.

This means business strategies will be scrutinised even more closely including the management and financing of risk. Organisations who may have traditionally funded risk costs like insurance policies - not forgetting the costs of deductibles and uninsured risks - from operating cashflow or debt would benefit from reviewing this process in order to reduce earnings volatility and strengthen debt servicing capabilities.

UP [Uninsured Percentage] was developed to simplify risk financing. It reduces premium costs and organisations can use the digital transformation of Management Information and Reporting Systems to onboard more insurance services as many did with banking services after 2008. UP also provides brokers and insurers with a means of providing sustainable risk financing structures that strengthen their clients financial shock absorbers.

“UP” pre-funding ensures improved risks visibility

whilst protecting business value and enhancing sustainability.

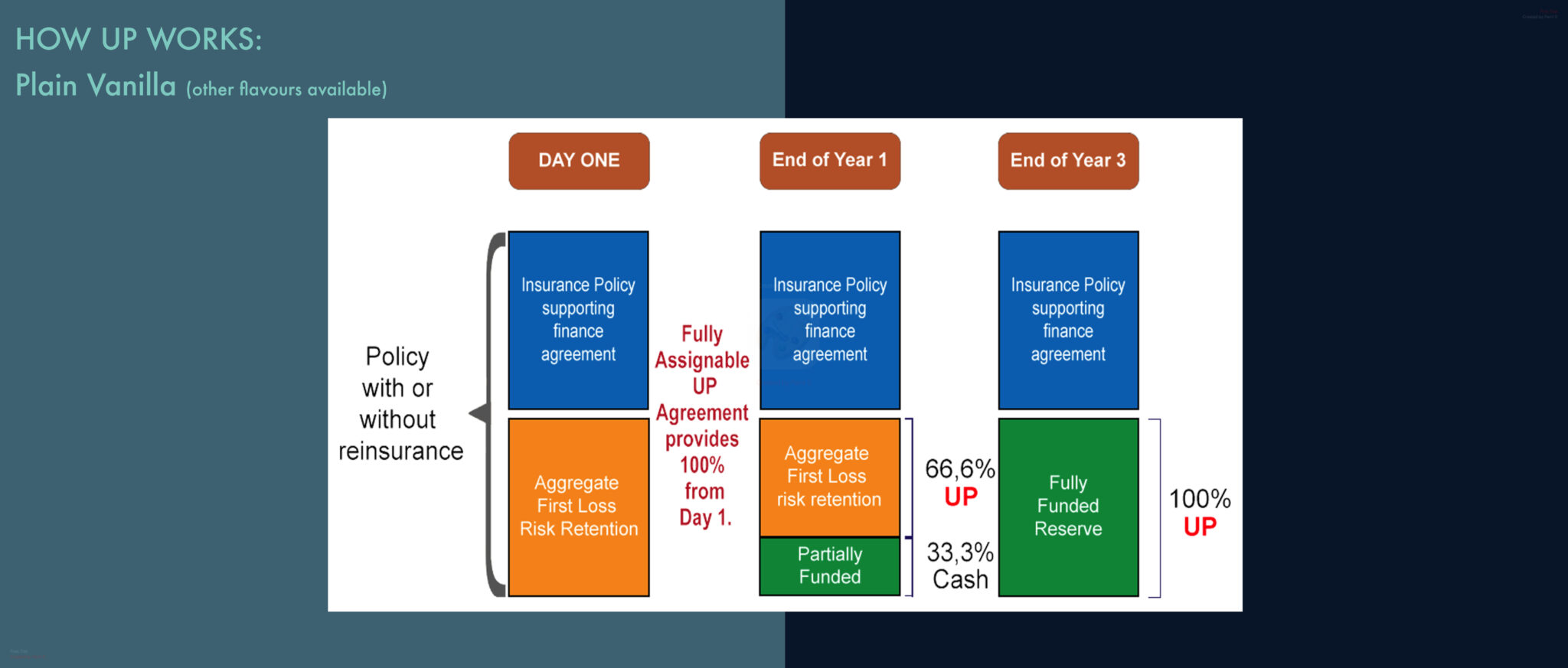

UP helps organisations seamlessly provision for unfunded risks from Day 1. We work with organisations, their placement brokers and insurers to build the best risk finance solution. Once the policy incepts, the client makes regular monthly payments into their own secured bank account. Claim costs are first met from bank account funds, and then the protection seller/insurance company to the agreed UP value. Any UP claim the insurer pays is repaid at terms competitive to alternatives like LoC's or overdraft facilities.

It is typically endorsed onto a normal insurance contract. If insurance is a funding or project finance requirement, UP can eliminate the need for borrowers to post cash collateral or provide an LC for unfunded risk gaps. We work with organisations, their placement brokers and insurers to build the best risk finance solution. Once the policy incepts, the client makes regular monthly payments into their own secured bank account. Claim costs are first met from bank account funds, and then the protection seller/insurance company to the agreed UP value. Any UP claim the insurer pays is repaid at terms competitive to alternatives like LoC's or overdraft facilities.

Increasingly, as many organisations see finance costs and free cash flow impacted by the Pandemic and the growing focus on net zero, the costs of trapped cash or utilising LC's will grow.

Using UP as part of an integrated corporate governance strategy (with risk financing costs easily allocated to individual business entities) can strengthen corporate governance and the going concern assessment process by reducing the impact of unfunded economic shocks and integrating more financial volatility into financial budgets.

The Pandemic, Net zero and ESG-related factors are putting a huge focus on operating costs. At the same time, new risks are emerging relating to technological, legal, operational, repetitional or financial change. Ultimately, they all impact credit risk.

Technology, risk data, AI, machine learning, remote sensing and satellite imagery are increasingly part of an organisations drive to reduce operating costs. UP is timely given the insurance markets response to the growth in extreme weather-related events has been to review the terms it offers its clients.

UP can therefore help improve the budgeting process by reducing the impact of unbudgeted risk events of unknowable timing hitting cashflow or finance lines.

Net Zero and ESG factors will become core to business strategies. Insurance and finance Co's are working together to bridge protection gaps organisations are increasingly exposed to as they decarbonise.

UP enables organisations to use digital transformation to bring more risk financing capabilities in-house, as they did financial services after 2008. This will usually drive costs down and reduce their exposure to Inflating premium and deductible costs.

Centinel 10 Ltd act as Calculation, Marketing, Structuring and Servicing Agent for UP transactions. We work with insurance companies, brokers, corporates and private equity partnerships to improve risk financing solutions that address the increasing challenges and financial shocks they face.